Abstract

This article is a follow-up to the knol article “Fair Value Pricing, Government Market Making and PPIP” and uses the concept introduced in the knol article ” Introduction to Basis Instruments Contracts (BICs) for Mathematics, Finance, and Economics”.

In this article we seek to estimate the proportion of assets ultimately held by the Government in a market making model, their cost and the parameters needed to make such estimates. This help us draw more effective comparative conclusions.

An important financial insight of this analysis is that we show that market making results in earning a spread that makes market making loss unlikely.

This article has methodological emphasis.

Introduction

In the previous article we argued that the best mechanism or architecture for revealing PPIP assets prices is through a market making process of those assets split to a refined level of granularity. The model presented therein to illustrate our argument merely looked at the scenario where no private bargain hunters step in to compete on the purchase price of the assets. As we stressed in the article there are many possible and more likely scenarios. In fact the probability of the scenario considered may decrease exponentially fast to zero as the number of assets to be disposed of increases. Sample scenarios look more like the graphs below.

The purpose of this article is to deepen analysis to to all the alternative scenarios and help answer fundamental questions a decision maker may need to consider:

- What inventory can we expect to hold at the end of a market making process ?

- How much can one expect this inventory to cost ?

- What would be the expected average unit inventory cost ?

- What is the likelihood of ending with no inventory ?

- What expected profit or loss would such no inventory scenarios entail?

In the process of making such estimations, the BICs framework will naturally emerge as the most efficient process for the most accurate estimates.

Analytic Framework

Analysis of the whole range of possibilities requires first describing the dynamics of the likelihood of alternative possibilities.

Incremental Possible Scenarios Representation

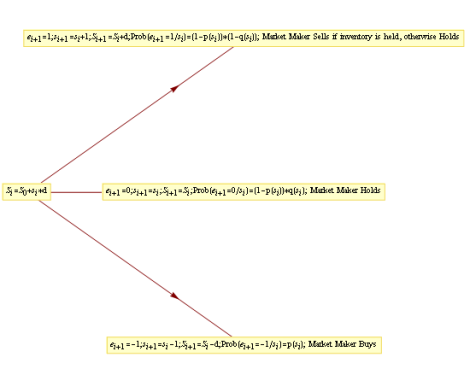

For each incremental unit asset disposition, the market maker may buy the unit asset if they are the highest bidder, sell the unit asset if it makes the lowest offer or see two third parties buy and sell if the settlement price falls in between. This incremental unit asset size may be chosen as the typical trade size that would cause price fluctuations. As such, for each incremental unit transacted, one can identify three possible scenarios:

- The high state case corresponding to the case where the market maker is making the lowest offer. In this case, the market maker sells the unit asset if there is any in their inventory.

- The middle state case corresponding to the case where the market maker is neither making the highest bid nor making the lowest offer. In this case, two third parties exchange the unit asset among themselves. at the same price as the preceding transaction price

- The low state case corresponding to the case where the market maker is making the highest bid. In this case, the market maker buys the unit asset.

One of the apparently simplifying assumptions of the the previous article was that of a constant depreciation rate on each next unit bought. This approach is very effective and reasonable to illustrate how granularity leads to a more effective price discovery process for which discount rate is not a substitute. In practice however, the standard is to depreciate or appreciate on constant basis points units rather than as a percentage of the preceding unit asset price. Compared to the constant depreciation rate approach, this practice accelerates depreciations as any fixed non zero unit basis point eventually becomes larger than any fixed proportion of a shrinking quantity; likewise, the practice decelerates appreciations as any fixed non zero unit basis point eventually becomes smaller than any fixed proportion of an exploding quantity. Since we focused in the previous section on how a depreciating asset works, a constant depreciation rate analysis is in fact more refined.

Once we decide to study both appreciations and depreciations in the unit asset prices, it is simply more realist to work from a unit basis points shifts approach.The incremental basis point move will be referred herein as d. The extent to which a market is liquid may be represented by the width of the bid/offer spread, which for the government market maker studied here is 2d. The larger the spread, the less liquid the market. An entity, governmental or otherwise that steps in to restore liquidity presumably does offers the minimum bid/offer spread on the unit underlying asset among all the other market participants.

These three incremental state possibilities may thus be effectively represented as:

- a basis point incremental increase compared to the price of the preceding unit asset transacted;

- a price that remains the same as that of the price of the preceding unit asset transacted or

- a basis point incremental decline compared to the price of the preceding unit asset transacted.

We can extend the number of possible states to more than three but that would not fundamentally change the analysis; a wider range of possibilities can simply be translated in this framework as further splitting the unit asset and considering the possible scenarios over correspondingly larger unit increments.

States probabilities distributions

As described above, at each stage, the transaction price of the incremental unit asset has three state possibilities corresponding to three probabilities of price evolution. Each one of these probabilities depends a priori on the path of the last traded incremental unit assets. A reasonable but expandable description of this dependence is to encapsulate it in the last traded incremental unit asset. When such a choice is made, the mathematical term used is to state that the incremental unit asset price is a Markov chain. Therefore, if p and q are two real functions on positive numbers whose values are constrained between 0 and 1, the probabilities of the corresponding 3 states may be described as:

- (1-p(Si))(1-q(Si)) for a basis point incremental increase compared to the price of the preceding unit asset transacted;

- (1-p(Si))q(Si) for a price that remains the same as that of the price of the preceding unit asset transacted;

- p(Si) for a basis point incremental decline compared to the price of the preceding unit asset transacted,

where 0<=p(Si),q(Si)<=1.

Realistic choices for the functions p and q must satisfy two basic constraints:

- For p, as Si goes further down the probability of continuing to go still down must decrease.

- For q, as Si goes further up the probability of continuing to go still up must decrease.

Note that choosing q = 0 reduces the future states possibilities from 3 to 2, an up and a down case.

The figure below summarizes our analytical framework

|

| Incremental Asset Prices Scenarios |

A canonical example of functions p and q satisfying the specified constraints

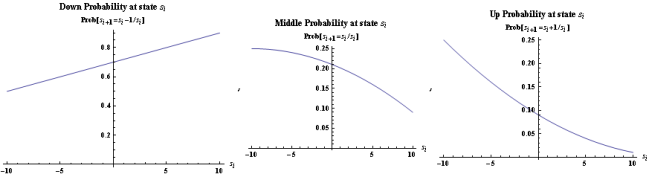

A simple way of defining p and q is to specify both of them as quadratic functions determined by the value for p and q at three different points. These values may be specified as the values associated with the minimum price of the unit asset, the maximum price of the unit asset and median unit asset price. The graphs below show sample down, middle and up state probabilities corresponding to p, q(1-p) and (1-q)(1-p) respectively.

The graphic representation makes intuitive sense as the down probability increases as the asset price increases and the up probability decreases as the asset price increases.

Underlying Selection

The underlying is the price S of the unit asset. The i-th unit asset to be transacted is denoted Si .

The underlying can also be reduced to the variable s taking the value 1 if the unit price goes up, zero if t stays the same and -1 if it goes down. For the i-th unit asset to be transacted, the corresponding variable s is denoted si If we assume the under .The correspondence between S and s is given by Si =S0+si*d; si=(Si-S0)/d;

Si+1 =Si+ei; ei in {-1,0,1};

We assume the number of illiquid assets to be disposed of is n.

Reformulation in Derivatives Pricing Terms

Answering the questions of a decision maker translated as pricing derivatives contracts

Answering the five questions posed can be translated into the pricing of five different path dependent derivatives contracts whose payout depends on the incremental unit asset prices along a pseudo time scale indexed by the exchange of an incremental unit asset between a buyer and a seller.

Each one of the questions is answered when the the realized value of the underlying up to the n-th asset is known. If we view transacting the i-th asset as the i-th time increment and the sought answer as a payout that is a function of the realized values of the underlyings, then estimating the expected outcome before any of the assets has been transacted is equivalent to pricing five different derivatives contracts where there are no interest rates and hence the discount factor is taken to be one

The argument for working with expectations

The choice of expectations to generate estimates is justified in this instance by the fact that the government a priori has access to unlimited liquidity and will be there forever so that the results of the law of large number, i.e. expectations should be its guiding tool in making decisions. Indeed when we deal with private entities constrained both in time and liquidity, decisions should preferably be tied to instruments that price the likelihood of future events into present contracts. This fact is often lost on macro-economists when analyzing private investors choice, with sometimes devastating results. Indeed this is where BICs are most helpful as risk management tool and instruments.

Payout Functions & Mathematical Statement of Computational Objectives

Having reformulated the problem in derivatives pricing terms, the payout payment functions for each of the 5 questions are as follows:

- The payout payment function whose expectation provides an estimate of the inventory we can expect to hold at the end of a market making process is In (s0,…,sn) defined recursively by:

Ii+1(s0,…,si+1) = (Ii(s0,…,si)-ei+1)+;

We need to to compute E0(In (s0,…,sn)), the expectation at time i=0 of In (s0,…,sn)

2. The payout payment function whose expectation provides an estimate of the amount spent to ensure liquidity on the n assets is Cn (s0,…,sn) defined recursively by:

Ci+1(s0,…,si+1)= Ci(s0,…,si)+(S0+si+1‘*d)*((-ei+1)1{Ii(s0,…,si)>0}+(-ei+1)+1{Ii(s0,…,si)<=0});

We need to to compute E0(Cn (s0,…,sn)), the expectation at time i=0 of Cn (s0,…,sn)

3. The payout payment function whose expectation provides an estimate of the average unit inventory cost we can expect Mn (s0,…,sn) defined recursively by:

If In = 0, Mn (s0,…,sn) = 0, else Mn (s0,…,sn) = Cn (s0,…,sn) / In (s0,…,sn)

We need to to compute E0(Mn (s0,…,sn) ), the expectation at time i=0 of Mn (s0,…,sn)

4. The payout payment function whose expectation provides an estimate of the likelihood of ending with no inventory If In = 0, Ln (s0,…,sn) = 1, else Ln (s0,…,sn) = 0

We need to to compute E0(Ln (s0,…,sn)), the expectation at time i=0 of Ln (s0,…,sn)

5. The payout payment function whose expectation provides an estimate of the profit or loss expected when one ends up with no inventory If In = 0, LCn (s0,…,sn) = Cn (s0,…,sn) , else LCn (s0,…,sn) = 0. Here one obtains the estimate as the quotient E0( LCn (s0,…,sn) )/E0(Ln (s0,…,sn))

The answer to any of the five questions that are the purpose of this article is a function of the inventory of assets held and the cost of any such inventory held after all unit have been transacted. The inventory and its cost possibly change incrementally as the number of unit assets transacted incrementally increase.

The Difficulties Associated with Traditional Derivatives Pricing

- Note:The engaged readers may stop here and try first to compute the five quantities defined above by themselves.

- If up to date on quantitative probabilistic methods, the reader will probably try one of the methods below.

There are three standard methods generally used for derivatives pricing problems: Trees, Monte Carlo and PDE methods

Trinomial Tree

The problem indeed is a trinomial tree type problem. This immediate instinctive approach that comes first to the mind of any trained probabilist is to equivalent to obtaining each one of the 5 estimates by computing the weighted sum of the outcomes in each of the 3n scenarios by the probability that said scenario would occur.

Using standard tree analysis for the problems at hand, the standard technical term is to conclude that this is a non-recombining tree whose complexity (3n nodes) explodes with n and therefore is impractical for large values of n.

Monte Carlo Method

The plain Monte Carlo integration algorithm bounds on the approximation are not tight and are provided only in order of magnitude terms and their convergence is known to be slow. As a result, in practice Low-discrepancy sequences are used. However, without extensive empirical investigation, it is easy to see how

Low-discrepancy sequences do not compare. Not only do they yield approximate rather than exact results, the best performing sequences (Sobol, Niederreiter) still have an error bounding discrepancy that is an exponential function of n.

PDEs

Trying PDEs is useless here since it is premised on a continuous space and time paradigm that would at best yield only approximate results on a problem that is discrete by definition.

The BICs Based Approach to Computing Multi-period Expectations

The terminology used here is explained in the introductory article on BICs

BICs, BICs set and BICs format used in this example

For each i-th incremental asset unit, there are only three possible next states, with their given probabilities, so it is most natural and efficient to take the BICs format used in this example is as the Arrow Debreu BICs set format and each time ti i = 0,…,n-1, and the three possible states translate into the following simplified for purose definition of the three BICs:

- An agreement contracted at time t0 to pay at time ti N(s0,s1,…,si)Prob(si+1=si+1/s0,s1,…,si) units of base currency and to receive N(s0,s1,…,si) units of base currency if and only if si+1=1

- An agreement contracted at time t0 to pay at time ti N(s0,s1,…,si)Prob(si+1=si/s0,s1,…,si) units of base currency and to receive N(s0,s1,…,si) units of base currency if and only if si+1=0

- An agreement contracted at time t0 to pay at time ti N(s0,s1,…,si)Prob(si+1=si-1/s0,s1,…,si) units of base currency and to receive N(s0,s1,…,si) units of base currency if and only if si+1=-1

where we note Prob(si+1=s/s0,s1,…,si) as the probability estimated at time t0 that si+1 will be equal to s when the values as yet unknown of s0,s1,…,si are given and therefore the probability is expressed as a numerical function of those variables. We further note that:

- The unit price process being a markov chain means unit BICs prices are merely functions of the underlying state and do not depend on the history of all the previous states, i.e. Prob(si+1=s/s0,s1,…,si)=Prob(si+1=s/si) . This is the assumption that is used in almost all derivatives models ; In a few cases, such as for interest rate derivatives modeling, one takes into account the history of realizations in a in a richer way that can be summarized in a few more variables, usually just one.

- The notional N(s0,s1,…,si) of the BICs may however a priori still depend only on the history of all the previous states, leaving us still with a serious computational problem that grows exponentially with n.

Eliminating the Curse of Dimensionality

This method of reducing computational cost is not obvious in other approaches without a BICs framed mind. For instance, make a Google search of the term “non recombining trees” and check the inefficient intellectual contortions made by the authors.

Efficient Representation of Notional Amounts Functions and Breaking Down the Curse of Dimensionality – States Variables Computation

One of the first things one can notice in this effort is that all the payouts depend on the final inventory of assets held and the cost of acquiring such an inventory. Since the probabilities depend solely on the state, we will show that it is sufficient to compress the information contained into s0,s1,…,si into the information contained into the triplet ( Ii Ci,si). The difficulty now becomes mapping the possible range of values of (s0,s1,…,si) which contains 3i elements into the possible range of values (Ii Ci,si). Indeed a substantially smaller range of values for (Ii Ci,si) will translate into a computational reduction by as much.

Ii+1(s0,…,si+1) = (Ii(s0,…,si)-ei+1)+;

If Ii(s0,…,si)>0, Ci+1(s0,…,si+1) = Ci(s0,…,si)-Si+1*(si+1-si), else Ci+1(s0,…,si+1) = Ci(s0,…,si)-Si+1(si)+ ;

There are usually two systematic ways of completing this mapping exercise.

States Variables Computation

The compressed state variables can usually be computated mechanically through a forward iterative loop.

Let’s suppose for a given i=0,…,n-1 the set (Ii Ci,si) is given. We compute (Ii+1 Ci+1,si+1) as follows:

- For any given (x,y,z) in (Ii,Ci,si), (x,y,z) can generate up to 3 distinct (x’,y’,z’) in (Ii+1,Ci+1,si+1) defined by the relations:

x’ = (x-e)+;

y’ = y+(S0+z’*d)*((-e)1{x>0}+(-e)+1{x<=0});

z’ = z+e; where e spans {-1,0,1};

- (Ii+1, Ci+1, si+1) is iteratively built by spanning the elements (x,y,z) in (Ii,Ci,si) and e in {-1,0,1} and adding the corresponding element (x’,y’,z’) into the set (Ii+1,Ci+1,si+1) provided such an element is not redundant.

The Mathematica implementation gives:

The step of computing and checking whether an element (x’,y’,z’) that is already in (Ii+1,Ci+1,si+1) is a redundant step that can usually be eliminated with further analysis; similarly, the output of the iterative process at step n can be computed directly without first computing the intermediary steps. It is intellectually a bit more demanding but saves computation time. The Mathematica algorithm that implements this method further details this approach.

The following graph shows a 3D representation of the triplet (I,C,s) for i=0,..25

It shows an almost one to one correspondence between inventory (width)and inventory cost (height)

Note that R2 above is a symbol for the coefficient of determination of a linear regression.

Both approaches and possibly other approaches can be admissible if the pricing process is to be repeated over time since once computed, the values can be pre-stored and just called the next time they are needed in the pricing algorithm as will be seen in the next section.

Note that the choice of basis points units spacing is often quite important in helping minimize the number of elements of the state variables. In this particular case, an uniform spacing that is in keeping with practical reality turns out to be computationally optimal. This type of strategic sampling issues, while not obvious, often occurs in numerical analysis. Aside from low discrepancy deterministic sequence which help in large dimension numerical integration approximate computations cases, in exact computations cases, the reader familiar with how a Vandermonde matrix inversion is simplified into a Fast Fourier Transform can appreciate the importance of such issues.

The BICs Backward Replicative Process for Expectations Computations.

We note Expect(I, C, s, i) the expectation for the vector of the five payout sought after trading the i-th asset given an inventory held I and a cost of acquisition C and with si = s.

- We know that Expect(I,C,s,n) = {I,C,If(I=0,0,C/I),1{I=0}, C*1{I=0}}

- The backward iterative sequence of expectation formulas is given as:

For i= n-1 to 0 step -1,

For j=1 to #StateVariables(i),

(I,C,s) = StateVariables(i)(j);

Expect(I,C,s,i) = Expect((I -1)+,C-(S0+(s+1)d))1{I>0},s+1,i+1)*Prob(si+1=s+1/s0,s1,…,si) + Expect(I,C,s,i+1)*Prob(si+1=s/s0,s1,…,si)

+ Expect(I+1,C+(S0+(s-1)d), s-1,i+1)*Prob(si+1=s -1/s0,s1,…,si);

- The final element is computed as Expect(0, 0, 0, 0) which is what we were seeking.

Numerical Analysis

We consider the case where we have one original illiquid asset S that we must dispose of. Its original value S0 equals 100. The unit basis point d = 1. The up, down or same scenarios have probabilities as shown in the graph above. The table below show the answer to our original five questions where we consider the unit asset broken down into 10, 15, 20 and 25 and 30 units.

One can notice that the expected final inventory fraction quickly converges towards the low end of the buy probability end for the market maker which here is 50% when the underlying asset reaches its lowest possible incremental unit value.

The unit asset cost decreases from the initial 100 to 96.28 and down to 91.5 and is likely to continue to go even lower as granularity increases.

The likelihood of holding no inventory at the end of the process decreases very quickly to zero.

Note that when there is no inventory, the market maker ends up with a positive cash flow (hence the negative sign) which represent the bid/offer spread from market making activities.

Conclusion

The liquidity re-establishment process through market making of granular assets seems to be structurally skewed toward efficiently restoring liquidity by purchasing illiquid assets at a discount. It also appears to restore liquidity by acquiring an inventory that is at the low end of the range that could be inferred from inputs of likelihoods of third parties stepping in to bid on the assets.

By contrast, the PPIF plan announced by the US Treasury 03/23/2009 seems structurally skewed towards efficiently restoring liquidity by purchasing illiquid assets at a premium.

This seems to further reinforce the argument of using market making of granular assets as a desirable means of restoring liquidity in a market at minimal costs.

My article in the 2009 summer edition of The Investment Professional uses BICs to analyze the flaws in the Treasury’s PPIP for Banks’ troubled assets.Check it out http://www.theinvestmentprofessional.com/vol_2_no_3/abstract-bics.html

August 15, 2009 editorial comment:“With signs of impending economic peril dissipating, the PPIP looks to become one of the greatest government programs that never were.Yet the structural tools used in the analysis here and the core criticisms they lead to makes it a Gedankenexperiment whose lessons are still very worth learning.”

Latest Updates

- CBO TARP costs estimate article (04/03/2009): http://online.wsj.com/article/SB123880278764488701.html

Note: Do not hesitate to contact me for code information related to this article.

Reference: This article’s tiny URL: http://tinyurl.com/dfp432